As a Senior Designer at Wahed, I worked on the redesign and UX enhancements of the Wahed Robo Advisor

mobile application (v2). Wahed is a fintech company specializing in ethical and Sharia-compliant investment solutions. This project aimed to improve the user experience, modernize the app’s interface, and incorporate new features to make it more user-friendly and engaging. This case study highlights the key steps and outcomes of the project.

My role: Senior UX/UI Designer

Company: Wahed Invest

Project duration: 4 months

Year: 2020

Skills: UX Research, UX Design, and Design System

Challenge

The existing Wahed Robo Advisor app had several usability issues and an outdated design. Users found it challenging to navigate and access essential investment information. The app’s visual aesthetics also needed a refresh to align with modern design trends. Additionally, we wanted to introduce new features to enhance the overall user experience and engagement.

Research and Discovery

We conducted extensive user research to address these challenges and our findings revealed the following key insights:

User Interviews: We conducted in-depth interviews with existing Wahed app users to understand their pain points, needs, and preferences. We also gathered feedback on the current app’s usability.

Competitor Analysis: We analyzed the user experience of other popular robo-advisor apps to identify best practices and areas for improvement.

Usability Testing: A series of usability tests were conducted to pinpoint specific issues within the existing app, such as confusing navigation and unclear investment options.

Discovered Key Pain Points: Users struggled to understand the investment options, lacked transparency in portfolio performance, and found the onboarding process cumbersome.

Design Strategy

Based on our research findings, we defined the following design goals:

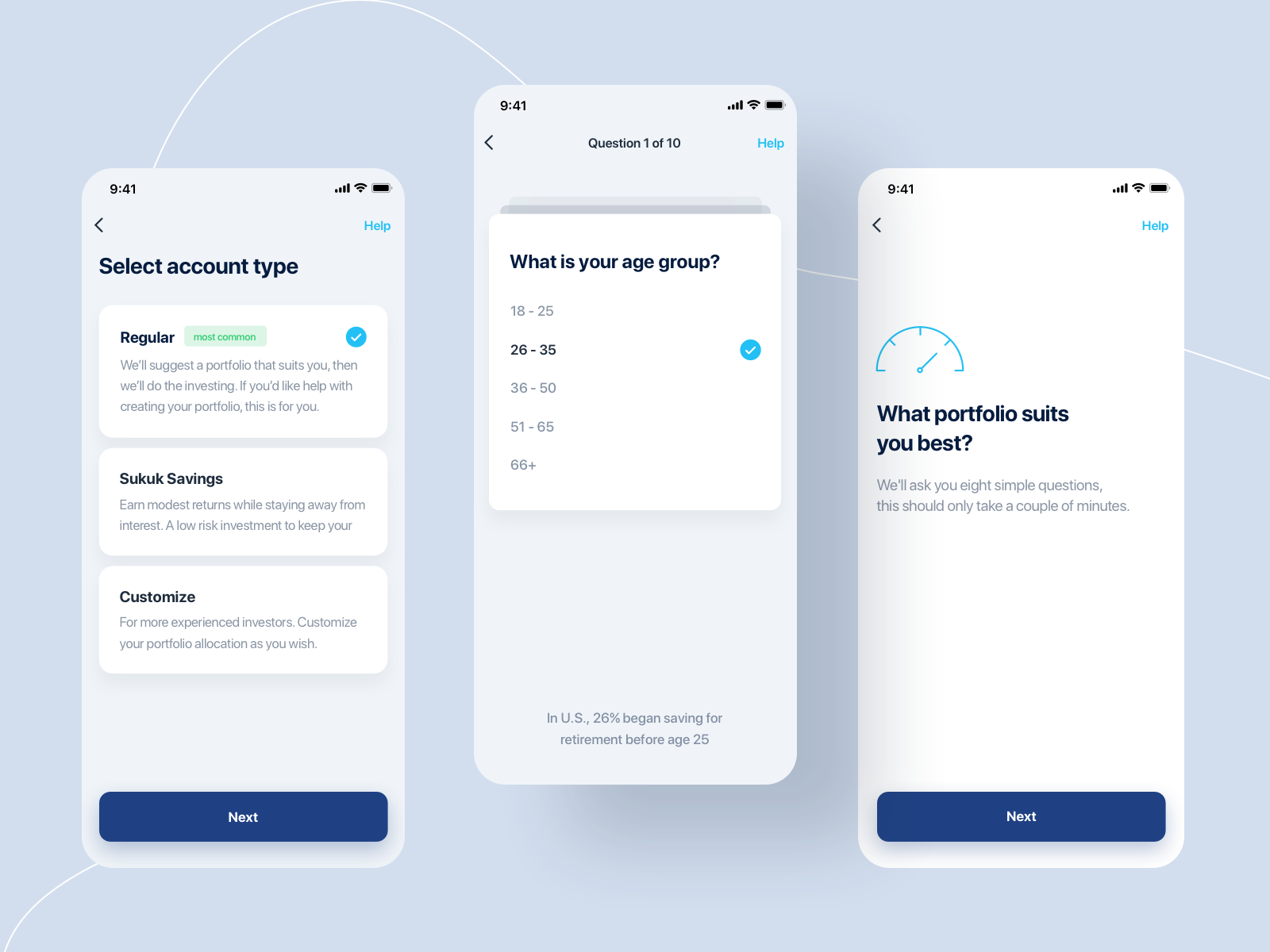

Simplify Onboarding: Create an intuitive onboarding process to help users set up their investment accounts effortlessly.

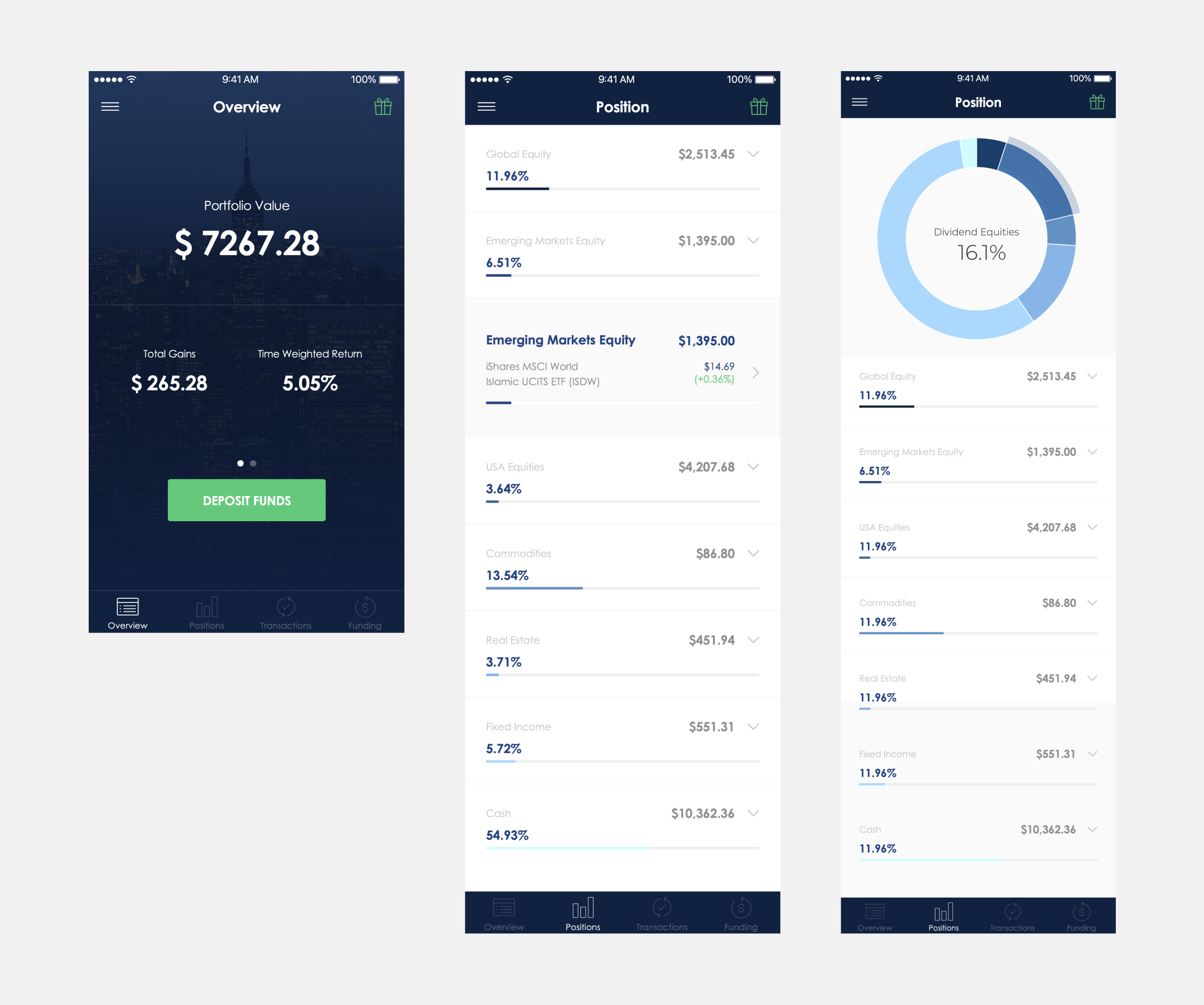

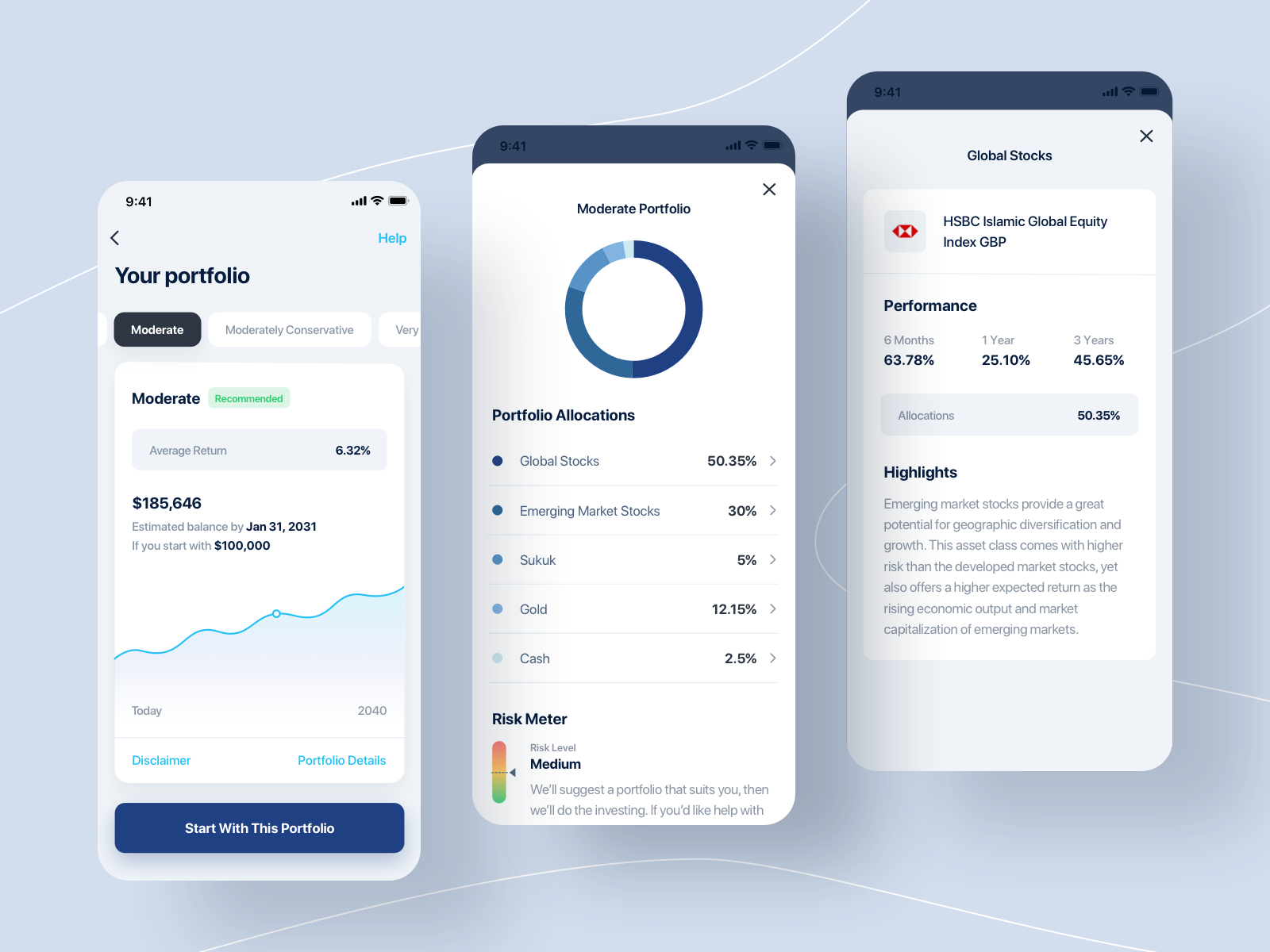

Enhance Main Dashboard & Portfolio Visualization: Provide users with a real-time view of their portfolio performance, including investment returns and asset allocation. Wahed app had a lot of usability issues.

Old Robo Advisor App:

Introduce New Features: Add new features like financial education resources, automated KYC flow, Real-time bank transfers & referral programs to increase user engagement.

Streamline Navigation: Simplify the app’s navigation structure to improve overall usability.

Modernize Design: Implement a modern and visually appealing design to resonate with the target audience.

Design Process

Information Architecture: We restructured the app’s information architecture, categorizing features logically and creating a more intuitive navigation flow.

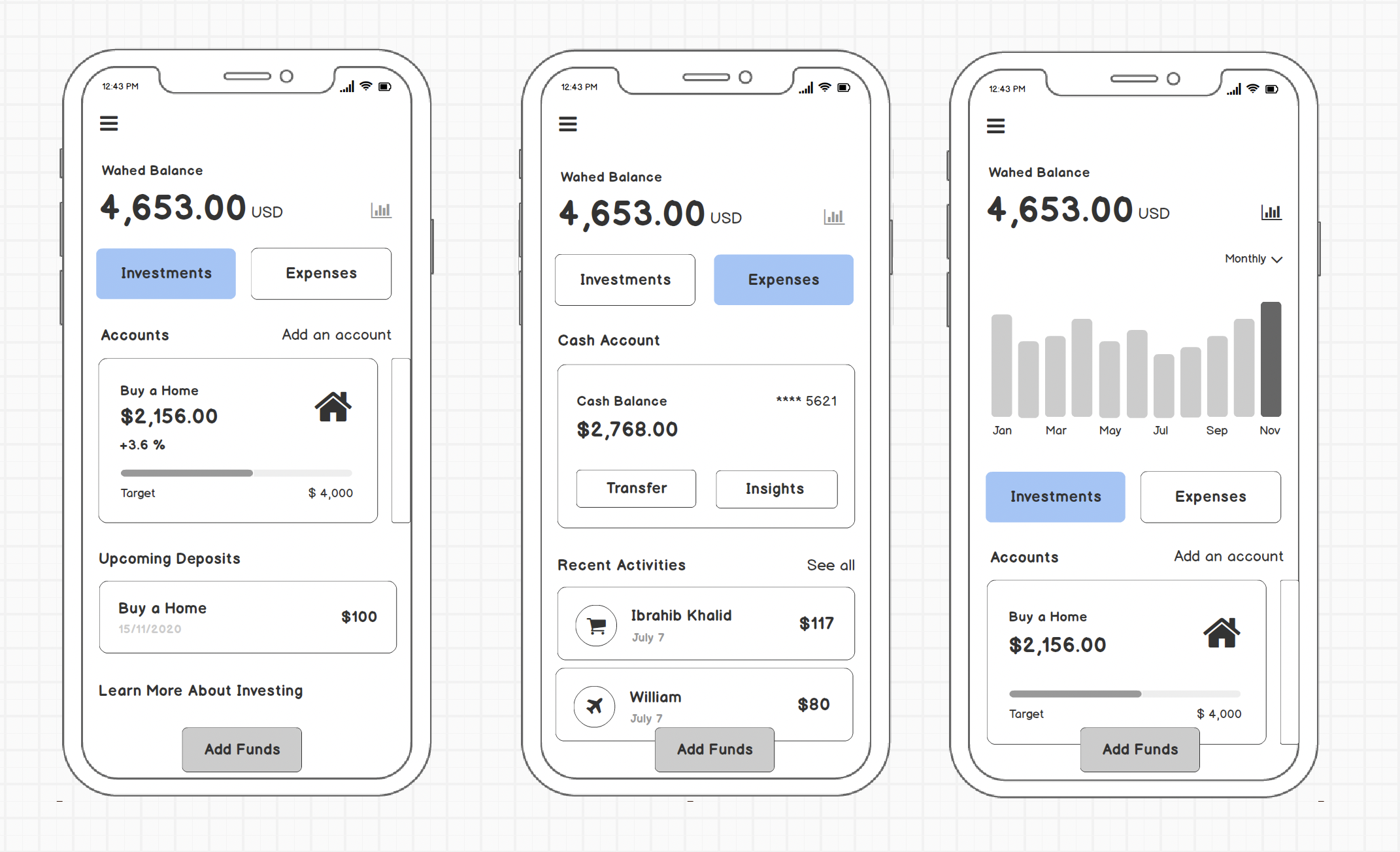

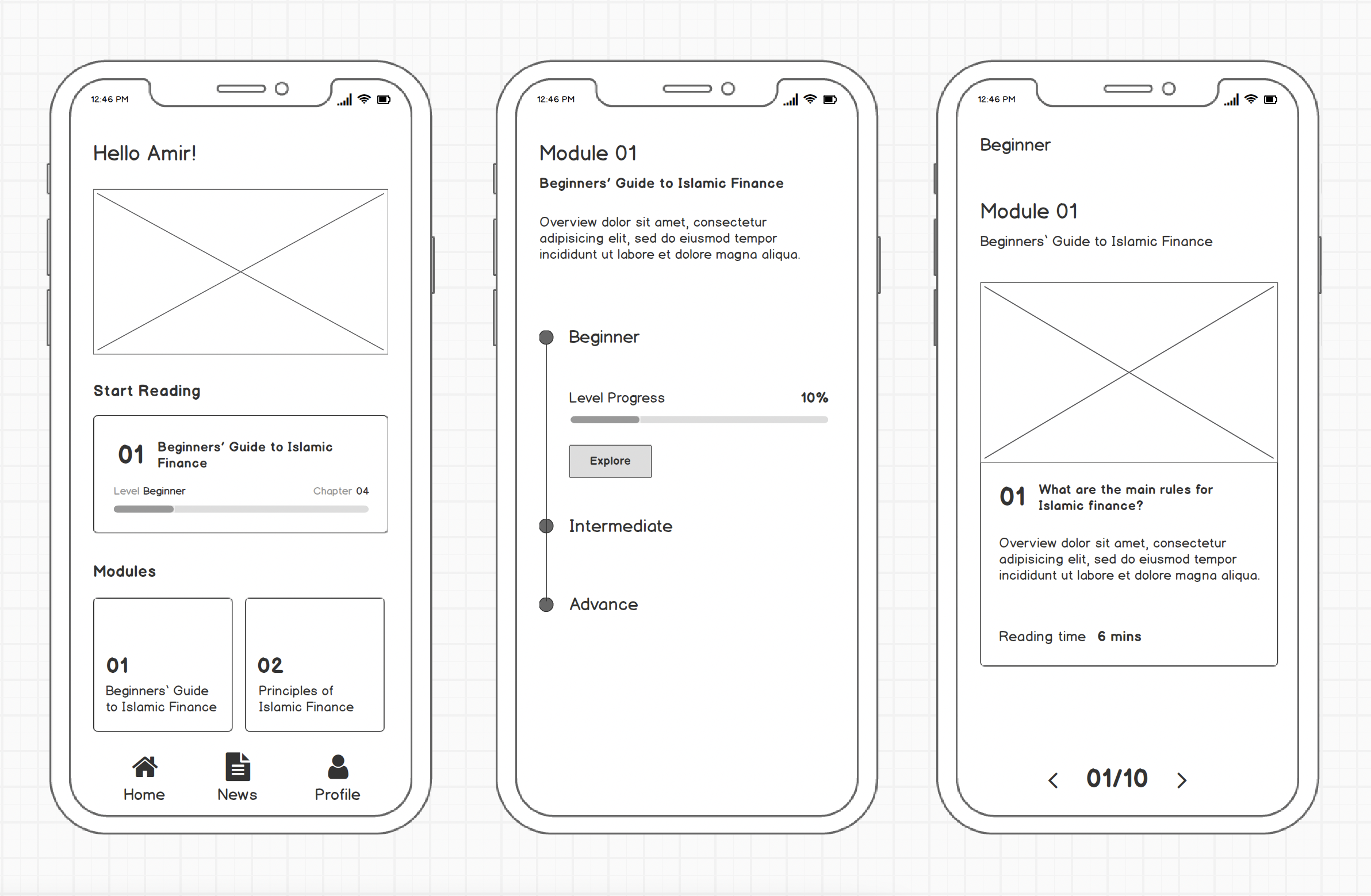

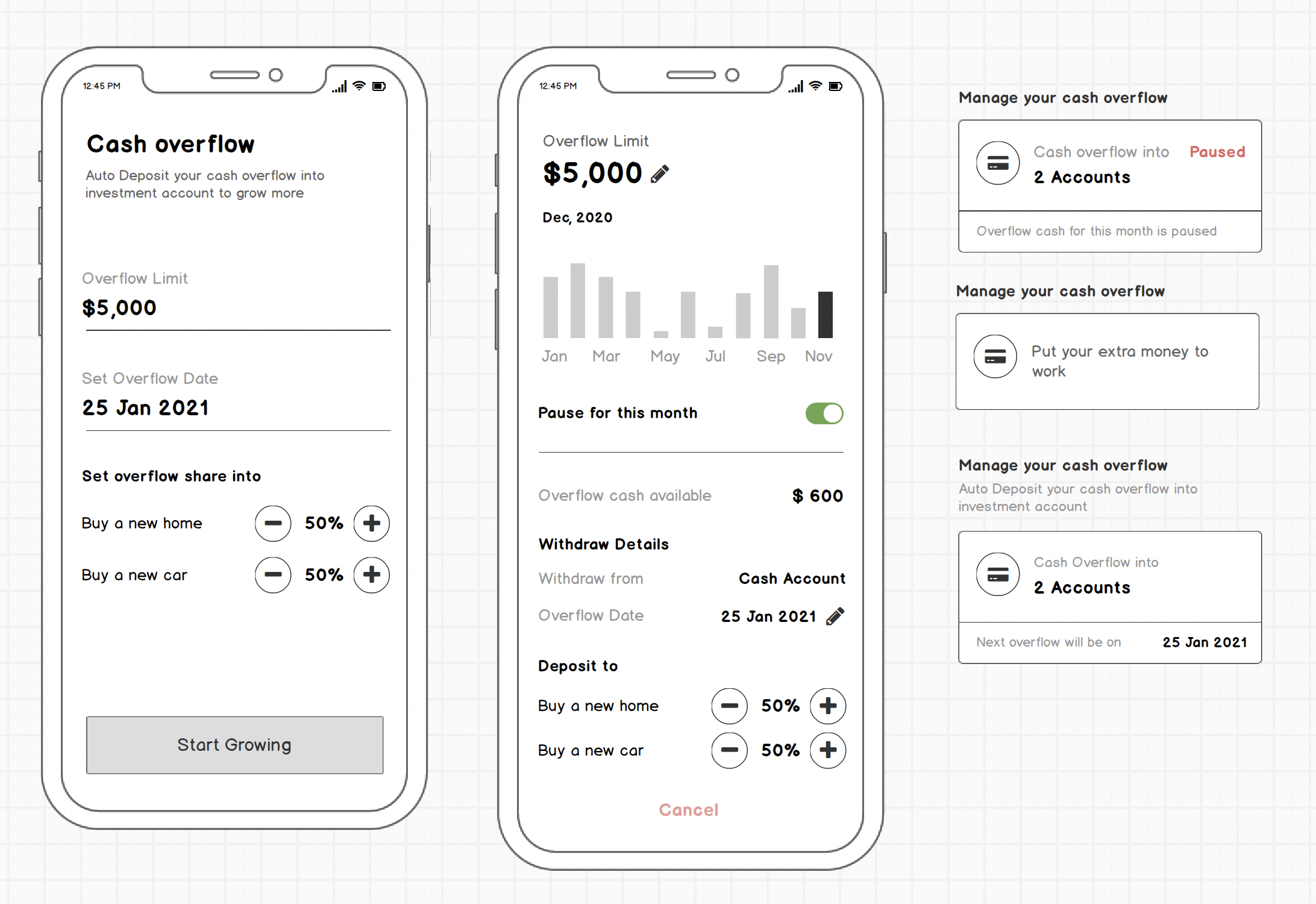

Wireframing: We created wireframes using Balsamiq to outline the new user flow, emphasizing the simplified onboarding process, improved portfolio visualization, main dashboards and education system building the app.

Main dashboards

In-build Financial education courses

Cash overflow into the investment account

Prototyping: Using tools like Figma, we developed interactive prototypes to test the redesigned user flow and gather feedback from users and stakeholders.

Visual Design: I worked on creating a modern and visually appealing design, incorporating brand colours and maintaining consistency throughout the app.

Development and Testing: Developers worked on implementing the design, while QA testers conducted thorough testing to identify and resolve any issues.

User Testing: We conducted usability testing with a group of users to gather feedback on the redesigned app and make necessary refinements.

Solution: Key Features and Enhancements

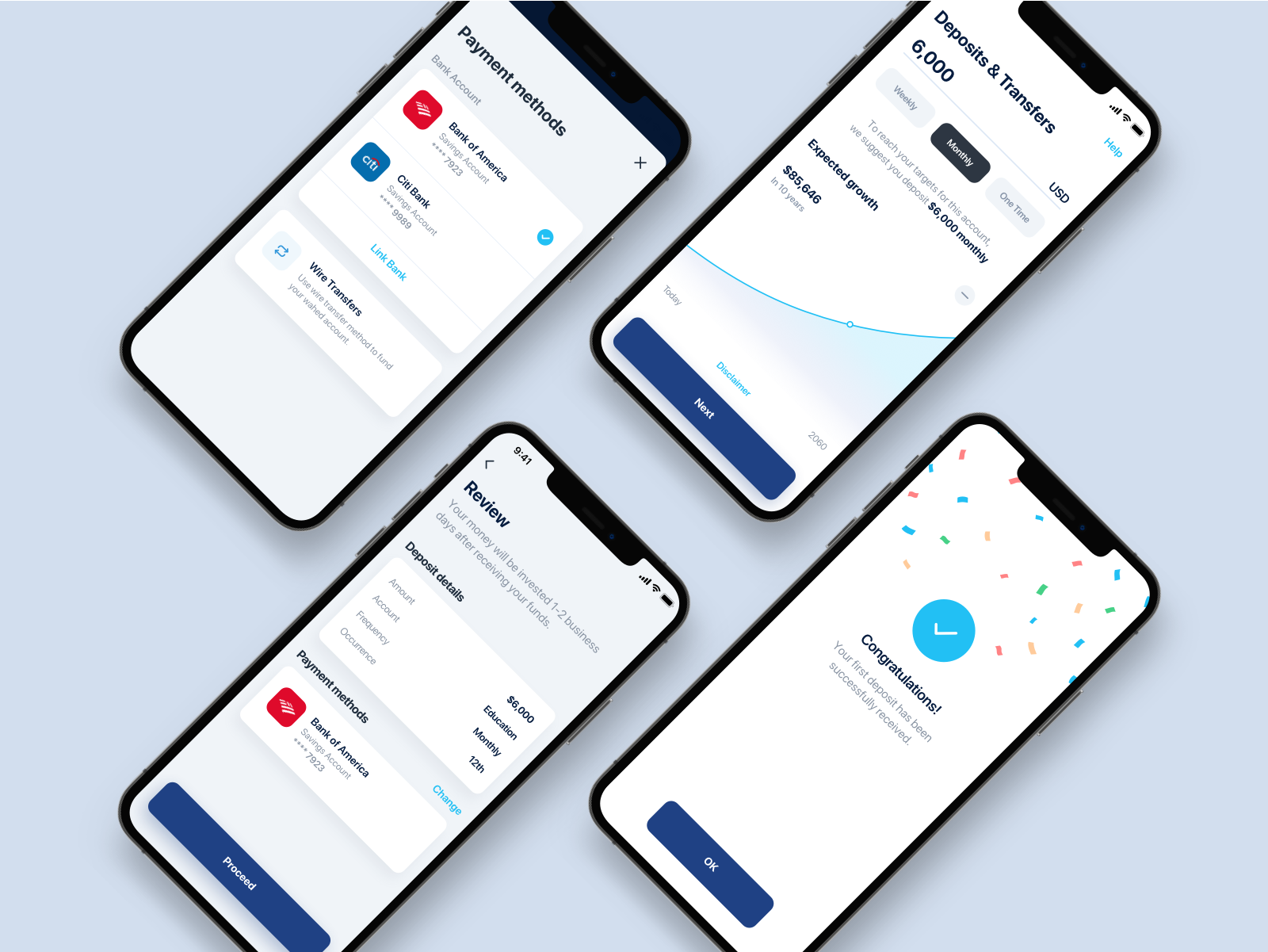

Simplified Onboarding: We redesigned the onboarding process, minimizing steps and providing clear explanations at each stage. Users could now set up their investment accounts quickly.

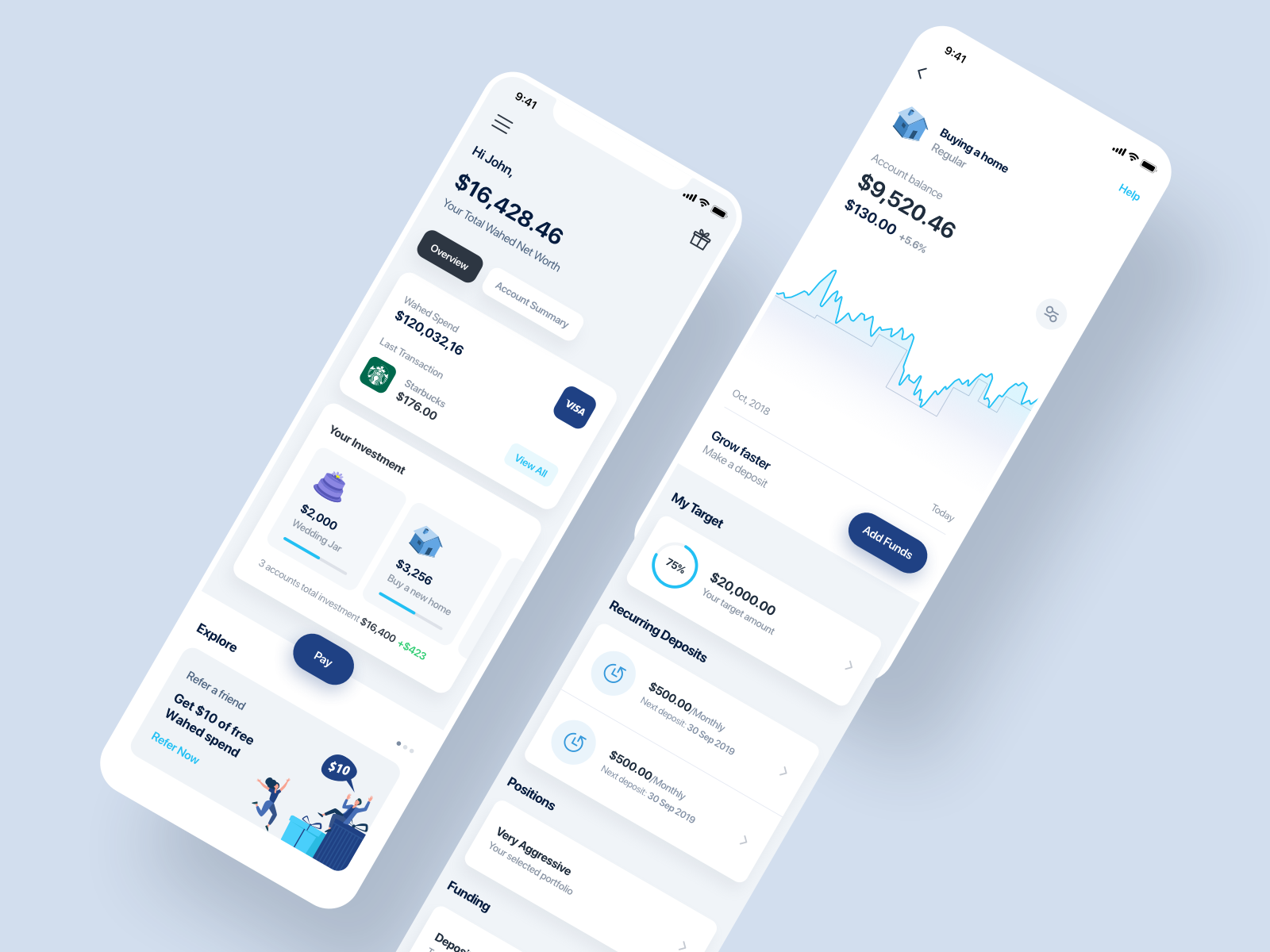

Portfolio Dashboard: The new portfolio dashboard offered real-time data on investment performance, asset allocation, and suggested actions, making it easier for users to manage their investments.

Goal-Based Investment: The “Multiple Accounts for Goal-Based Investment” feature saw a 20% increase in user adoption, as it resonated with users looking to invest strategically.

Streamlined Navigation: We revamped the app’s navigation, introducing a bottom navigation bar with clear icons and labels to improve accessibility.

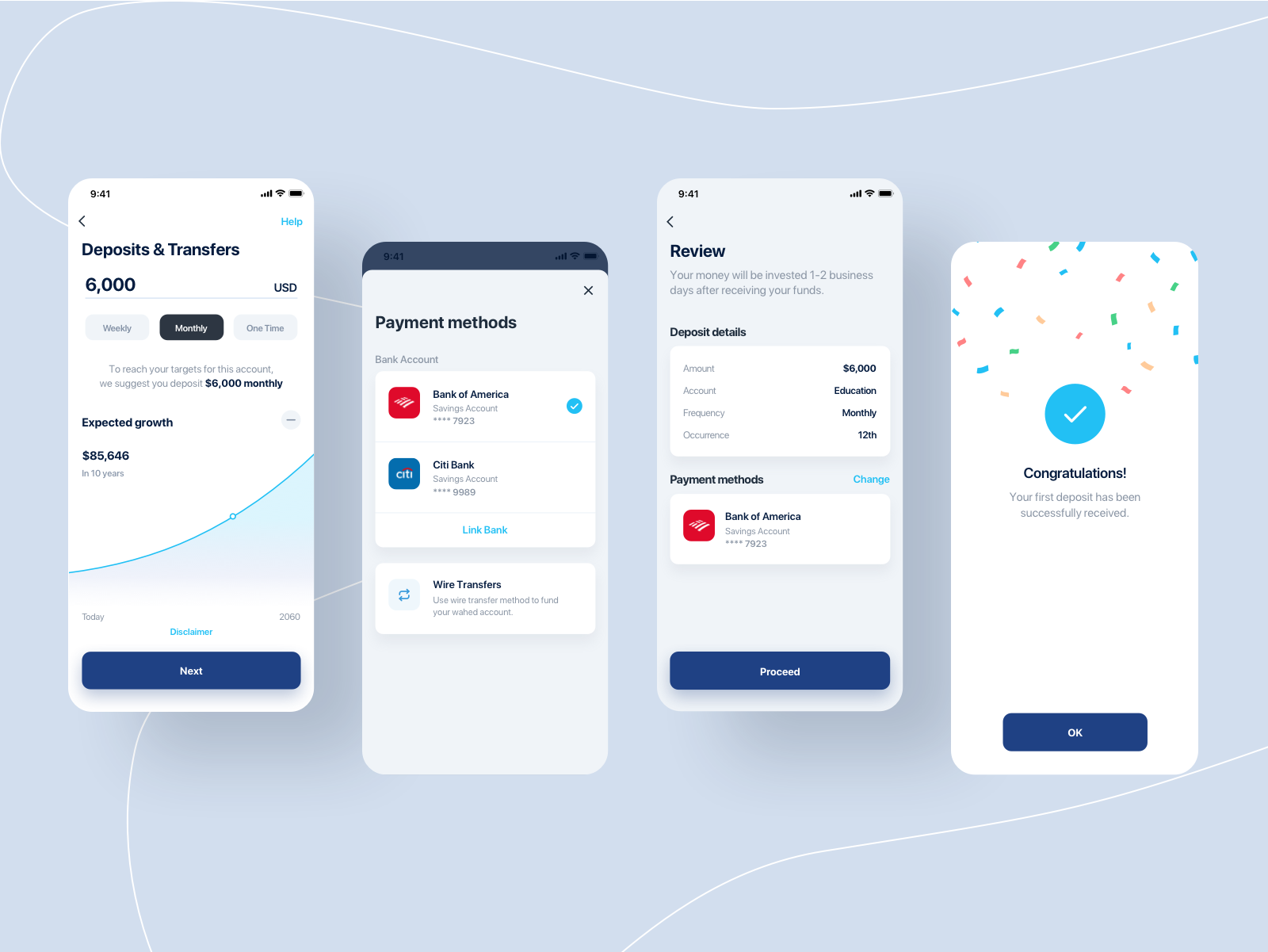

Automated KYC & Real-time deposit: We have incorporated a new KYC flow to verify the customer’s identity based on the selfie and other personal documents such as driver’s license, passport etc. We have integrated real-time bank transfers for emotional investing in Wahed accounts.

Modern Visual Design: The new design featured a clean and minimalist look, with vibrant colours, intuitive iconography, and a user-friendly typography system.

Results

The redesigned Wahed Robo Advisor app (v2) was launched to positive feedback from users and stakeholders. Key outcomes included:

Improved User Engagement: The introduction of new features, such as financial education and social sharing, resulted in increased user engagement and retention.

Simplified Onboarding: The simplified onboarding process led to a significant reduction in drop-off rates during account setup.

Enhanced User Experience: Users reported a much-improved overall experience with the app, with particular praise for the portfolio dashboard’s clarity and ease of use.

Positive Brand Perception: The modern design and improved usability contributed to a more positive perception of the Wahed brand in the fintech industry.